News

Indonesia’s purchasing managers’ index (PMI) contracted to 50.3 points in November

15 Dec 2022

Persisting sluggish global and domestic demand means Indonesia’s manufacturing sector faced worsening downward pressure in November, while infl­ationary pressure began to ease as consumption continued to weaken.

Citing the latest report from financial research firm IHS Markit, a subsidiary of S&P Global, Indonesia’s PMI contracted two-month straight to 50.3 points in November, the slowest in five months, and just slightly above the expansion threshold of 50. In September, Indonesia’s PMI was at an eight-month high of 53.7 points.

Source : https://www.thejakartapost.com/business/2022/12/01/stubbornly-low-demand-squeezes-indonesian-manufacturers-harder.html

Unexpected slump in China's October exports and imports

01 Dec 2022

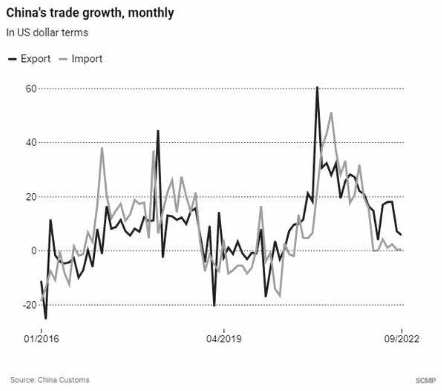

China's exports and imports unexpectedly contracted in October, the fi­rst simultaneous slump since May 2020, as a perfect storm of Covid curbs at home and global recession risks dented demand and further darkened the outlook for a struggling economy.

The bleak data highlight the challenge for policymakers in China as they press on with pandemic prevention measures and try to navigate broad pressure from surging inflation, sweeping increases in worldwide interest rates and a global slowdown, reports Reuters.

Outbound shipments in October shrank 0.3 per cent from a year earlier, a sharp turnaround from a 5.7 per cent gain in September, official data showed on Monday, and well below analysts' expectations for a 4.3 percent increase. It was the worst performance since May 2020.

The data suggest demand remains frail overall, and analysts warn of further gloom for exporters over the coming quarters, heaping more pressure on the country's manufacturing sector and the world's second-biggest economy grappling with persistent Covid-19 curbs and protracted property weakness.

Growth of auto exports in terms of volume also slowed sharply to 60 per cent year on year from 106 per cent in September, according to Reuters calculations based on customs data, reflecting a transition from demand for goods to services in major economies.

Source : Shipping Gazette

The global shipping industry is facing a new problem

01 Dec 2022

While there was a shortage of containers at the height of the pandemic, the global economy is now facing the opposite problem: too many containers. Traders and shippers say the decline in global consumer demand is not a sign the global economy is normalizing after a frantic post-lockdown consumption rush but a downward shift in consumption appetites.

Blank or canceled sailings are also on the rise in what is usually the opposite, as the year’s biggest spending period approaches. It points to more signs of falling global demand and an impending economic slowdown.

To combat full and overflowing depots, ports such as the Port of Houston have started levying fees for empty containers sitting in terminals for more than seven days.

Source : https://www.cnbc.com/2022/11/11/global-shipping-industry-faces-a-new-problem-too-many-containers.html

Blibli marks second biggest IPO in Indonesia this year

01 Dec 2022

Blibli was offi­cially listed on the Indonesia Stock Exchange (IDX) and it performed relatively well on the primary share offering for domestic investors and qualified institutional international buyers.

It is claimed to be the second-biggest internet unicorn in Asia Pacific to go public this year, with a market capitalization of Rp. 53.3 trillion. Blibli went public together with its subsidiaries Tiket.com and Ranch Market and the tripartite listing stood under the umbrella of PT Global Digital Niaga. This move was meant to facilitate an “omnichannel” approach that integrated online and oine distribution, promotion and communication.

Source : https://www.thejakartapost.com/business/2022/11/08/officially-going-public-blibli-marks-second-biggest-ipo-on-idx-this-year.html

Indonesia posts USD 5.7 billion trade surplus, beating forecasts

01 Dec 2022

Indonesia's trade surplus widened to USD 5.67 billion in October from USD 4.99 billion in September, as imports were less than expected, statistics bureau data showed on Tuesday.

The resource rich Southeast Asian economy has benefited from high prices of its main commodity exports, such as palm oil, coal and nickel, for more than a year.

Economists have warned that once commodity prices moderate and the global economy slows, Indonesia's export earnings would tail off and its trade balance could come under pressure from sustained domestic demand driving up imports.

In October, however, the strong rise in imports was still less than expected. Data showed October imports rose 17.44% from a year ago to USD 19.14 billion, below a forecast rise of 23.62%. On a monthly basis, imports shrank by 3.4%, with purchases of machinery, fuel, and gold driving the decline.

Meanwhile, exports in October rose 12.3% from a year ago to USD 24.81 billion, which was the weakest year-on-year increase since February 2021, and below the poll forecast for 13.85% growth.

Source : https://www.nasdaq.com/articles/indonesia-posts-$5.7-bln-trade-surplus-in-october-beating-forecasts

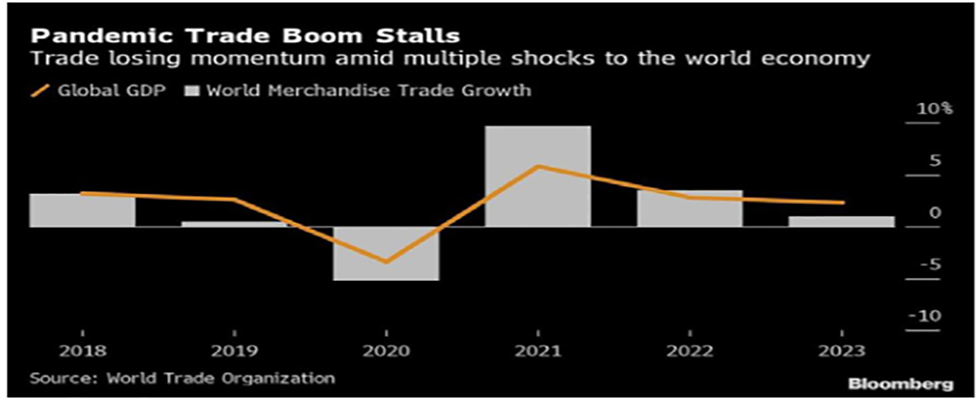

World Trade Organisation Slashes 2023 Trade Forecast

15 Nov 2022

The World Trade Organisation (WTO) has cut forecast global trade growth for 2023 to just 1%, down sharply from its previous estimate of 3.4%, saying the war in Ukraine and infl­ation are set to weigh heavily on economies.

In its latest report, the WTO said import demand was expected to soften more than initially forecast as different regions were hit by varying negative factors. High energy prices resulting from the Ukraine war is expected to impact European spending and increase manufacturing costs, while China grapples with continuing COVID outbreaks that have disrupted production at the same time as it faces weaker overseas demand for its products. Meanwhile in the US tightening monetary policy is expected to curb spending.

The WTO admitted that its previous forecasts made in April now appeared overly optimistic. This suggests there could be an even greater deterioration in trade conditions next year compared to the current year.

China’s Monthly Exports Growth Slowed To 5.7% In September

15 Nov 2022

China’s export growth slowed in September, as exports grew by 5.7% last month from a year earlier, compared to 7.1% growth in August, according to the delayed data released by China Customs.

The September figure was below expectations of a 5.8%. Imports, meanwhile, grew by 0.3% in September from a year earlier, unchanged from 0.3% growth in August, and below expectations of a 1.3% rise.

Indonesia’s Inflation Surprisingly Drops As Food Prices Cool Down

15 Nov 2022

Infl­ation slowed in October following a drop in a wide range of food commodities, but analysts expect the drop to be temporary as risks overshadow the economy in the remaining weeks of the year.

The annual headline figure eased to 5.71 percent last month, down from the 5.95 percent year-on-year (yoy) recorded in September, according to Statistic Indonesia (BPS) data published on Tuesday. The latest figure was well below projections of several analysts. State-owned lender Bank Mandiri and financial research-firm Moody’s Analytics, for instance, had expected a reading of 5.91 percent and 6.1 percent, respectively.